Why contacting abandoned loan applicants should be a critical piece of your lending strategy.

What Happens When an Applicant Abandons Your Online Loan Application?

Many Credit Unions don’t know. They lose track of the partial applicant long before they really understand the applicant’s intent.

Orange County's Credit Union found themselves in the same situation prior to integrating with Clutch. Without this critical data, there was no means to reach back out to these applicants or to automate retargeted marketing.

After partnering with Clutch, Orange County's Credit Union was able to email members within 20 minutes of abandonment as well as automate the mailing of a 6x9 postcard. 1 in 6 (17.5%) applicants who had previously abandoned the application returned to complete a loan application as a result of Clutch's appraoch.

Credit Unions often do not have the technical capabilities to distribute automated marketing via email, text, and direct mail to applicants who abandon loan applications.

Most Credit Unions will see loan abandonment rates between 40-60%. New member origination costs are often more than $300. It's imperative to make sure that Credit Unions are doing everything they can to convert as many potential loan applicants that start an application. Many Credit Unions are also under-staffed, have tight budgets, and may not have the ability to manually reach out to applicants in a timely manner.

Clutch’s first product, the loan application portal, is a streamlined, modern loan application designed to allow Credit Unions to improve their digital lending experience, increase conversion rates, and boost cross-sell rates through some unique features such as utilizing a soft-pull of the member’s credit to surface pre-qualified offers and refinance opportunities to the member.

Clutch’s loan portal logs all user actions and captures a user’s contact information early in the process. The marketing is targeted specifically across auto loans, personal loans, and credit cards based on actions the user took.

Users identified for retargeting were sent an email and a postcard within 20 minutes of their abandonment which included the best rate they were pre-qualified for based on their credit history and Orange County's Credit Union's rate sheets.

"During our partnership with Clutch, they helped us develop a well-rounded automated retargeting marketing strategy. We saw an instant increase in conversions and loan growth. The success of our initial plan led us to expand from sending one targeted email per product to a sequence of three follow ups!"

Jeff Harper

Chief Lending Officer

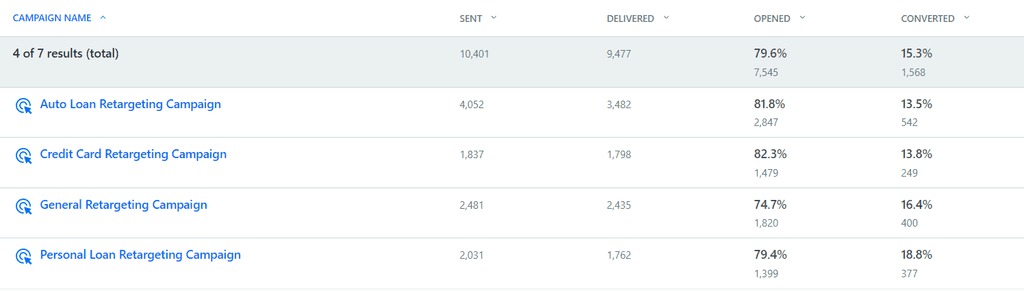

Clutch's retargeting efforts yielded impressive results across multiple metrics. The average open rate of 88% signifies a high level of engagement from the retargeted individuals.

The average click-through rate of 30% demonstrates that the retargeting emails successfully motivated recipients to take the desired action, which was to click the call-to-action button to revisit the loan application process.

The most significant outcome was 17.5% of the individuals who initially abandoned the loan application decided to return and complete it after receiving the retargeting email and postcard.

The case study reveals that Clutch's retargeting efforts resulted in a significant increase in total consumer loan volume. Approximately 9% of the total app volume was attributed to retargeted individuals who applied after receiving the retargeting emails. This indicates the substantial value-add provided by Clutch to their Credit Union partners.

Implications and Benefits

Clutch's case study demonstrates the significant impact of retargeting – and we encourage all clients to engage here as highly as possible to increase share of wallet and loan origination.

By effectively targeting and converting potential applicants who would have otherwise been lost, Clutch's retargeting strategy not only increased app volume but also contributed to the overall success of Orange County's Credit Union. This demonstrates the potential impact of automated retargeting campaigns in capturing missed opportunities and driving business growth.

The findings of this case study have several implications for Credit Unions. Implementing automated retargeting campaigns for abandoned loan applications can provide the following benefits: